Think of us as the bridge between you and your auto finance goals. We’ll connect you to an auto lender that’s right for you — whether you’re looking to refinance your car, purchase your leased vehicle, or buy a company car.

Financial Resources

Digital Experience

Our Services

White-glove Services

Tresl Auto Refinance

When is the best time to refinance your car? How about now! Tresl customers save on average, $129.49* a month on their car payments!

*Annual savings equals 12 multiplied by the average monthly payment savings of customers who acquired a new auto loan via Tresl from September 1, 2025, to February 28, 2026. Actual annual payment savings varies.

If you’re thinking of purchasing your leased vehicle, Tresl can help simplify the process. Even better, we work with you wherever you are.

Tresl offers competitive loan rates and can help you avoid those excessive dealership buyout fees.

Tresl makes purchasing a company car from your employer easy.

We make the process surprisingly simple… Our proprietary platform allows us to manage vehicle payoff so that you can complete the process conveniently through text, telephone, and email.

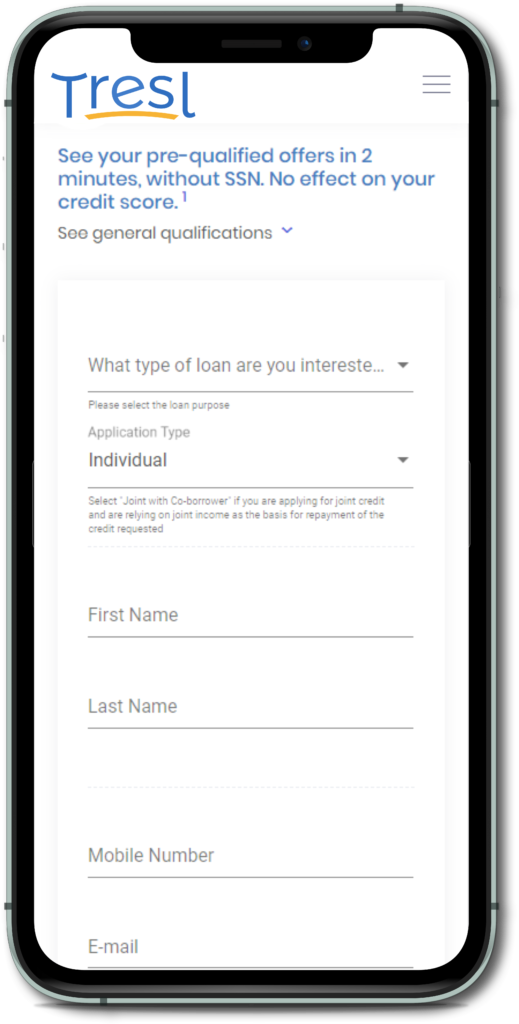

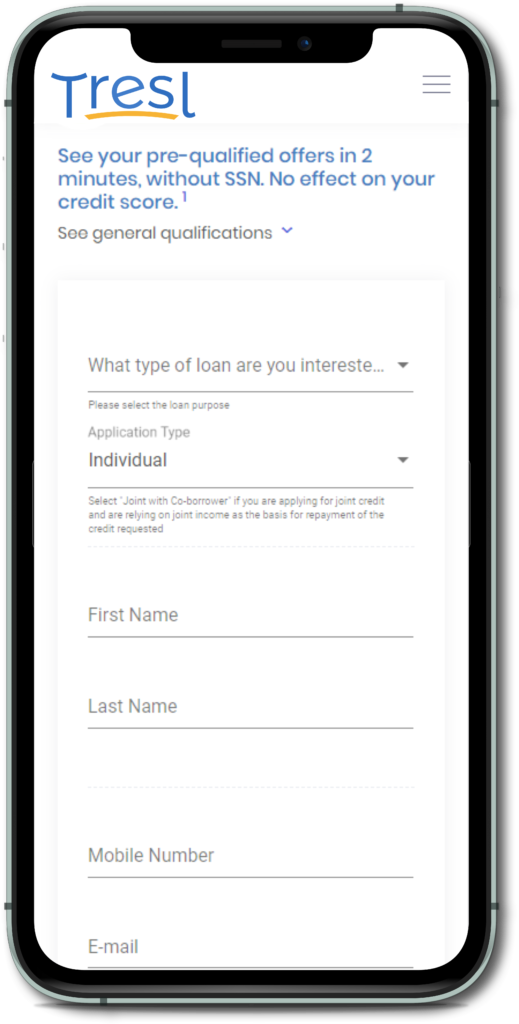

1. About You

Provide basic information about yourself.

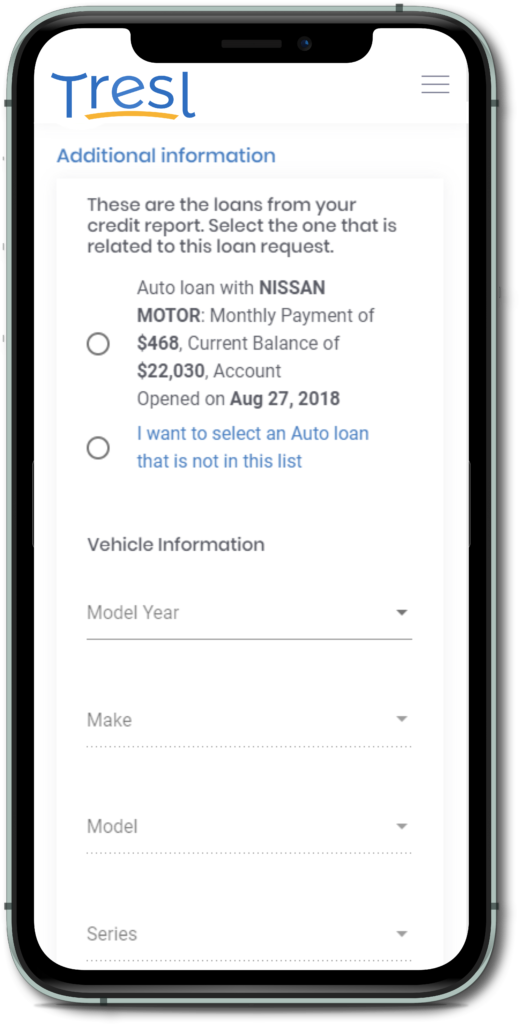

2. Vehicle Info

Tell us about the vehicle you are financing. If applicable, select the tradeline from your credit report that corresponds to the vehicle.

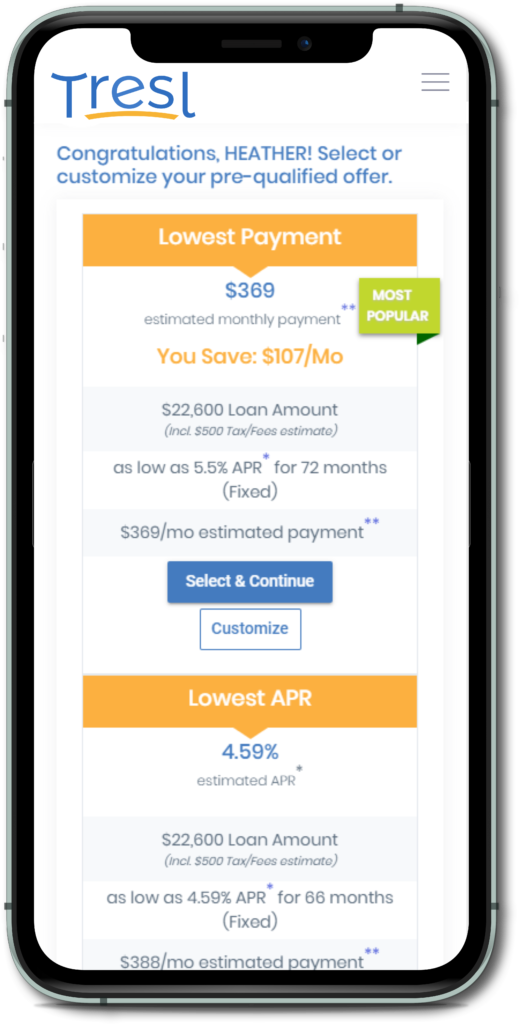

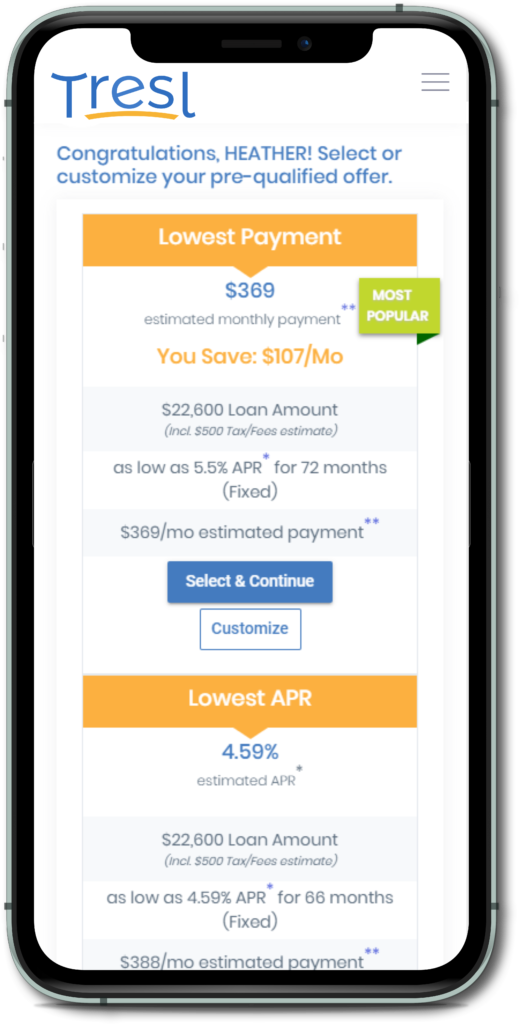

3. Pre-qualified Offers

Review your pre-qualified offers from our lender network. Select the offer that supports your unique goals.

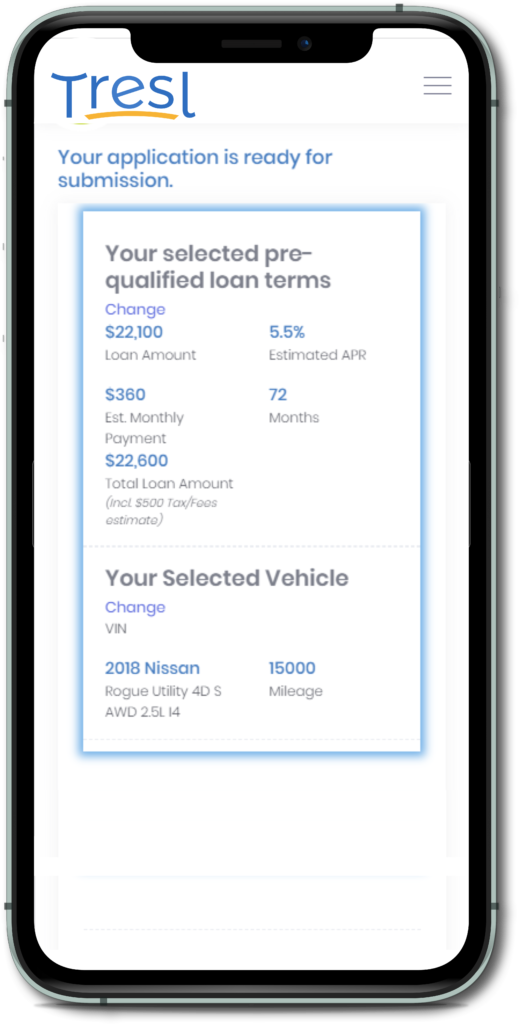

4. Submit Your Application

Submit your pre-qualified application. Your dedicated Finance Advisor will work with you by phone, text message, and email to refine your selection and guide you to the full loan approval that meets your goals.

Innovative Funding Services Corporation d/b/a Tresl® is part of The Savings Group. Tresl is a registered trademark of Innovative Funding Services Corporation.

© The Savings Group, Inc., All Rights Reserved

Texas Motor Vehicle Dealer License #P169185