Tresl, a multi-lender Fintech, announces minority interest in SaaS Fintech leader CreditSnap and joint initiative to democratize Fintech.

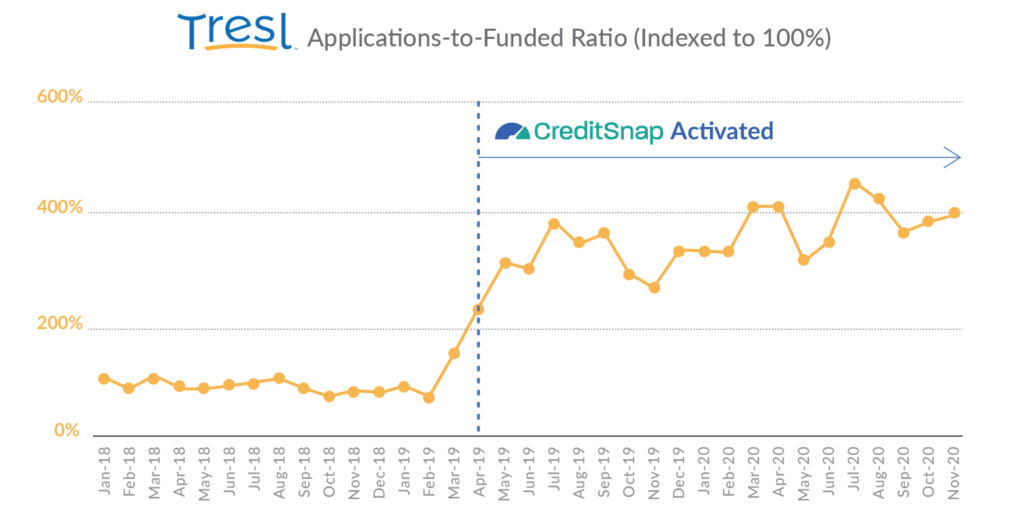

Austin, Texas, USA, January 26, 2021 — Tresl, a multi-lender Fintech that connects consumers with beneficial financial resources, announced today that the company has made a strategic investment in the next generation lending platform CreditSnap. Tresl will also take a seat on CreditSnap’s board of directors. San Antonio, TX based CreditSnap is an award winning fintech company that provides a lending and account opening platform to Banks and Credit Unions as a white labeled product. This same platform powers Tresl’s market-leading digital pre-qualification experience and helped Tresl achieve a +100% improvement in look-to-book ratio as well as improved customer satisfaction in both its auto refinance and auto purchase loan channels. Based on the overwhelming positive results, the two firms agreed to align officially with the shared objective of serving the needs of the Bank and Credit Union community.

Along with the strategic investment, Tresl and CreditSnap are also announcing an alliance to bring a new joint product proposition to market known as “BankingAmplified.” This new product takes inspiration from Tresl’s industry-leading customer experience and fulfillment capabilities, and CreditSnap’s pre-qualification based digital experience capabilities. It is a unique solution designed to support Banks, Credit Unions and Lending Institutions in achieving their digitization and customer growth goals in a turnkey approach.

The BankingAmplified program enables financial institutions to do the following:

Tresl President and CEO, Christine Pierson stated, “CreditSnap’s pre-qualification engine served as a strong technology platform to fuel Tresl’s own growth over the last two years. The CreditSnap system integrated seamlessly with Tresl’s proprietary digital platform, and it has allowed us to deliver more quality funded loans to our lending partners and a great lending experience to our customers. With the new BankingAmplified product offering, we aim to offer a complete turn-key Fintech enablement solution to Banks and Credit Unions, enabling them to effectively compete with major Fintech lenders in the marketplace today.”

Deepak Polamarasetty, President and CoFounder of CreditSnap, added “Unlike Fintech lenders, Banks and Credit Unions are uniquely positioned to deliver personalized financial solutions to their customers. What they lack, however, is the same cutting edge technology that solves for customer experience. BankingAmplified empowers these lending institutions to strike a healthy balance of Tech and Human Touch: a) Digital experience powered by next generation technology (CreditSnap), and b) Result-oriented customer experience that integrates 100% digital experiences with the consultative, omnichannel support of finance experts (Tresl).”

Background: The relationship between Tresl and CreditSnap is one that began in late 2018 when Tresl was looking for an innovative way to deliver highly accurate pre-qualified rates & terms to its customers—one that reflected the diversity and competitiveness of Tresl’s lender network. After extensively evaluating multiple solutions, Tresl found that CreditSnap’s SaaS solution was superior. After some rapid configuration and setup, Tresl deployed CreditSnap’s pre-qualification engine in early 2019, overnight becoming CreditSnap’s largest client. In conjunction with other proprietary technology & operational optimizations Tresl has undertaken, the CreditSnap pre-qualification engine has allowed Tresl to unlock strong results, including over 100% improvement in look-to-book ratio and improved customer satisfaction.

By offering innovative, turnkey technology and customer experience solutions that Banks, Credit Unions, and other lending institutions have long been searching for, Tresl and CreditSnap hope to democratize Fintech!

If you represent a lender and are curious about how BankingAmplified could help your organization reach its goals, contact us today!

About Tresl: Tresl (formerly IFS) is the ultimate personal finance support platform. Since 2007, Tresl has equipped customers to reach their financial potential by intelligently connecting them with beneficial financial resources for auto purchasing, refinancing, and more from its partner network of Credit Unions, Banks, and Lending Institutions. Throughout the company’s end-to-end process, its customers benefit from the support of its cutting-edge financial technology and consultative team of expert finance advisors, enabling them to make the financial decisions that are right for them.

About CreditSnap: CreditSnap, a FinTech consumer lending platform, aims to democratize soft inquiry based lending and account opening technology for small and large credit unions and banks. With instant offers, real time collateral valuation, next generation mobile responsive experience, loan offer customization, LOS and Core Integrations, and more, CreditSnap is the first digital enablement platform that allows Banks and Credit Unions to achieve digital enablement and customer experience goals without changing their current tech stack. CreditSnap has processed more than 480,000 loan and account opening applications for its Bank, Credit Union and Fintech customers.

For more information, please get in touch:

Innovative Funding Services Corporation d/b/a Tresl® is part of The Savings Group. Tresl is a registered trademark of Innovative Funding Services Corporation.

© The Savings Group, Inc., All Rights Reserved

Texas Motor Vehicle Dealer License #P169185