The Difference Between an Interest Rate and the Annual Percentage Rate APR on an Auto Loan

Most car loan contracts list two rates, your APR and your interest rate.

Interest rate or note rate is the lower of the two rates and represents the cost per year of borrowing money – NOT including fees or interest accrued to the day of your first payment.

APR (or annual percentage rate) is the higher of the two rates and represents the total cost of financing your vehicle per year (as a percentage), including fees and interest accrued to the day of your first payment. APRs are useful for comparing loan offers from different lenders because they reflect the total cost of financing. The higher the APR, the more you’ll pay over the life of the loan.

Mathematically, these rates will give you the same monthly payments and will result in you paying the same amount for your car in the long run. However, the higher the APR, the more you’ll pay over the life of the loan. Lenders will give you both rates on your car loan paperwork so that you can better understand your loan.

The distinction between these rates is simple in many ways, but it is important that you understand how to interpret each.

Interest Rate vs. APR

When you buy or finance a car, you may borrow more than your car is worth for multiple reasons (this list is not exhaustive).

- To purchase protection products like a Vehicle Service Contract, GAP Insurance, or a Tire and Wheel Protection Plan

- In order to cover the taxes you owe on your purchase

- Pay for your prepaid finance charges

The money you borrow to pay for add-on products and taxes goes directly towards what is called the “amount financed.” It is the amount you borrow to make your purchase. Essentially, the amount financed reflects how much you would pay for your car even if you purchased it with cash (i.e. without financing).

Your prepaid finance charges, on the other hand, are part of your “finance charge.” Your finance charge is what you pay to compensate the institutions that help you purchase your car. Most borrowers think of finance charges as the interest charges they pay on their loans, and this is correct. However, your finance charge is also made up of charges and/or fees you pay when you purchase your vehicle. These charges, are known as prepaid finance charges and are usually bundled into your financing so you do not have to pay them out-of-pocket. Your prepaid charges may also include the interest that accrues to the day of your first car loan payment.

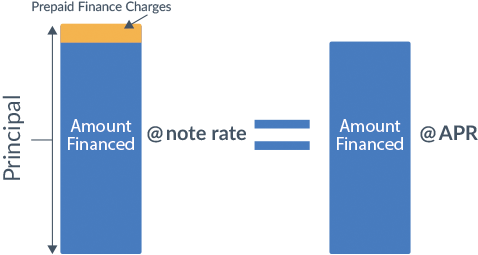

The difference between APR and your note rate lies in how you choose to look at your prepaid finance charges.

If you prefer to think of your prepaid finance charges as a type of charge you pay to get your loan, then your APR will reflect how much you pay each year in total to compensate the institutions that help you finance your car. Both your interest charges and your prepaid finance charges will count as such compensation (i.e. your finance charge), and you will pay these charges in accordance with car loan amortization (amortization just refers to paying a debt in a structured way).

In keeping with how car loans are structured, you will pay more interest charges and prepaid finance charges near the beginning of your loan than near its end. Amortization of prepaid finance charges is discussed in more detail near the end of this document (and you can read more about car loan interest charges here).

If instead you prefer to think of your prepaid finance charges as simply part of your loan, almost as if they are part of the purchase price, then your note rate will reflect how much you are paying on top of your loan principal (i.e. the amount you borrow) to your lender for your loan.

The graphic below illustrates the relationship between an APR and a note rate.

Want to Lower Your Car Payment?

Example: How to Calculate APR for a Car Loan

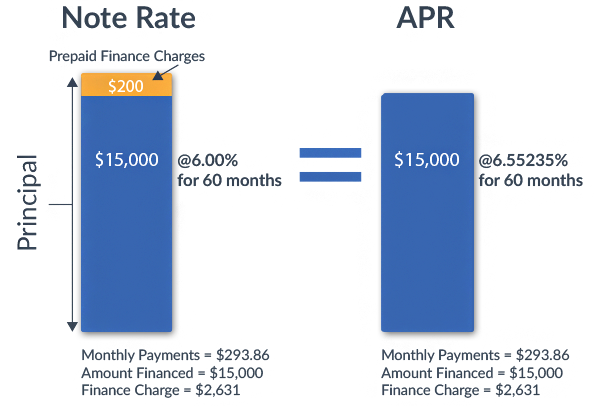

Suppose you want to purchase a car for $15,000. Using a car loan service, you find a lender that agrees to give you a 60 month car loan for this amount at a 6% interest rate (i.e. note rate). Your loan will come with $200 in prepaid finance charges, meaning your principal will be $15,200 [$15,200 = $15,000 + $200]. What would your APR be?

To figure out your APR, first track down your monthly payment. If you are curious how car payments are calculated, here is the formula:

Basically, all you need to know to calculate your car loan payment is the length of your loan in months, your principal, and your note rate (i.e. interest rate). If you plug in the numbers (or use the calculator), you will find that your monthly payment for this loan is about $293.86.

To find your APR, you theoretically could use the same equation. Your payment under your note rate and APR should be the same. All that changes when calculating APR in this equation is that you would use the amount financed (which does not include prepaid finance charges) in place of your principal. Ultimately, you would plug in your monthly payment and amount financed and solve for the interest rate part of the equation – which is not easy to do mathematically since the interest rate appears twice in the equation.

Still, the APR you would get if you did this would be about 6.55%. The graphic below illustrates how the note rate and APR will give you the same monthly payment and finance charge for your loan.

These rates will give you the same monthly payments and will result in you paying the same amount for your car in the long run. However, the higher the APR, the more you’ll pay over the life of the loan. Lenders will give you both rates on your car loan paperwork so that you can better understand your loan.

Example (continued): An Alternative Way to Calculate APR for a Car Loan

Another way to calculate your APR is to think about what your note rate and APR actually reflect.

Your note rate reflects the interest charges you pay per year for the amount you borrow (i.e. your principal) whereas your APR reflects the portion of your finance charge you pay per year for the amount you finance (i.e. your amount financed). The equations below represent these concepts.

(Note, the “loan amount” is the balance of the principal and the “interest charges” are those paid in a 12 month period)

(Note, the “loan amount” is the balance of the amount financed and the “interest charges + prepaid charges” are those paid in a 12 month period)

You cannot really use these equations directly to calculate your note rate and APR, because your loan amount (i.e. your principal or amount financed) falls during the course of your loan as you pay it down, and as you pay off your loan balance your interest charges fall in accordance with amortization (again, you can learn how car loan interest charges work here).

However, you can estimate your note rate and APR using an average of your loan balance over a 12 month period.

You would pay $838.89 in interest charges under the note rate during the first year and $905.02 in interest charges + prepaid finance charges in your first year under the APR. To calculate an estimate of the note rate, you can divide the $838.89 by the average loan balance over the first year, which is $13,978. You will get a note rate of roughly 6% [6% = $838.89/$13,978].

And if you want to estimate the APR, you can divide the $905.02 by the average balance of the amount financed over the first year, which is $13,888. Your estimated APR will be about 6.52% [6.52% = $905.02/$13,978], which is very close to the 6.55% APR in this example.

You can use the procedures described above over any 12 month period of your car loan to calculate an estimate of your note rate and APR. But you would never need to use these calculations since your loan documents will give you all the information you need on your car loan. Hopefully, however, these calculations give you more insight into the relationship between your note rate and APR.

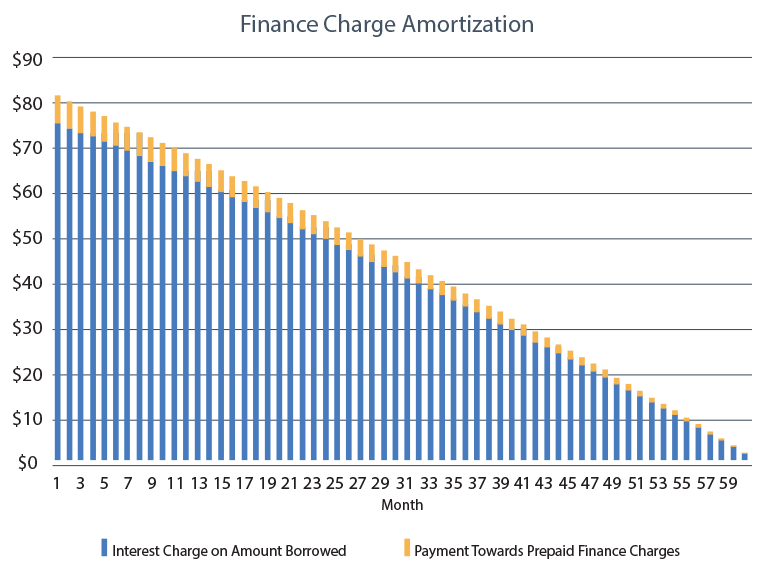

Amortizing Your Prepaid Finance Charges

You pay your prepaid finance charges at the beginning of your loan, hence the term “prepaid.” Still, you pay back the principal on your loan (which will likely include your prepaid charges) with your monthly payments, so you can think of your prepaid finance charges as another type of interest charge. Because of how car loan interest works, you pay more interest at the beginning of your loan than near the end as your loan balance decreases, a process known as amortization. So, under APR you pay your prepaid finance charges via amortization as well.

In our example, the $200 of prepaid finance charges are paid down via amortization as the graph below depicts (in orange).

The orange portion of the lines depict the portion of the finance charge for each monthly payment that is made up of the prepaid finance charges. As you can see, both the blue interest charges and the orange prepaid finance charges decrease over the course of the loan as you pay down your loan balance. If you add up all the interest charges and prepaid finance charges, you will find that the total finance charge is $2,631, making the total of payments for this loan $17,631 [$17,631 = $15,000 + $2,631 OR $17,631 = $293.86 x 60 months].