What To Consider When You Buy a Leased Car

At the end of a car lease, you generally have two options. You can either return the vehicle to the leasing company or you can buy the leased car.

A car lease buyout is different than buying a typical new or used car. Not only do you have knowledge of your leased car’s history (because you have been driving it) but you have a few financial considerations that are unique to car lease buyouts.

When you consider buying a leased car, you know exactly how much you can buy the car for, and you can calculate your final end-of-lease fees. Everything about your end-of-lease purchase option should be specified in your lease agreement. However, it takes careful consideration to know if you should buy your leased car.

Let’s look at some of the most important lease buyout considerations.

The Leased Car's Purchase Price

Like with all car purchase decisions, one of the most important factors to consider when buying your leased car is the price. Most lease car agreements specify exactly how much lessees can buy their leased car for at the end of their leases. This price is equal to the residual value of the vehicle.

Residual Value

The residual value of a leased car is the value the leasing company expects it to depreciate to over the course of a lease.

Since you have to pay for the depreciation of your leased car during your leasing period, your leasing company calculates this value when determining your monthly lease payments. However, the residual value of your leased car will probably not equal its market value at the end of your lease. By comparing the residual value (or “purchase option price”) of your leased car to its market value, you can get some sense of if you are getting a good deal with a car lease buyout.

Residual Value vs. Market Value for a Car Lease Buyout

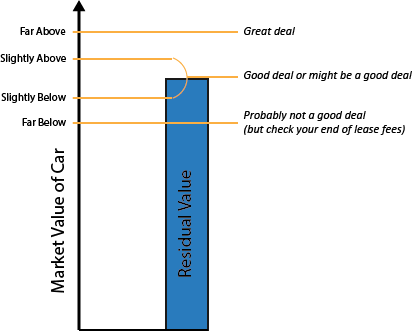

When buying your leased car, the higher its market value the better. Obviously, if your car’s market value is high above its residual value, you get a great deal by purchasing it. But your end of lease fees can make a lease buyouts a good deal even when the purchase price is less attractive. If for instance, your leased car’s value is slightly below its residual value, purchasing it may still be a good deal when your end of lease fees are high. See the figure below.

Moreover, with a car lease buyout, you typically get a car that has only been used by you, meaning you have an assurance of its condition. It is only when your leased car’s market value is far below its market value that you are probably getting a bad deal (unless you are buried in end of lease fees).

The graphic below illustrates how a leased car’s market value can differ from its residual value at the end of its lease.

You have various ways to find the market value of your leased car. Probably the quickest way to find an estimate of your leased car’s value is to visit websites like Edmunds, Kelley Blue Book, NADA Guides, and others.

No hard and fast rules exist for determining the leased car’s purchasing value. Each car lease buyout is different and requires its own quantitative and qualitative analysis. Usually, if a car’s market value is within a few hundred dollars of its residual value, then purchasing it is likely a fair deal. And always take your end of lease fees into account when considering your car lease purchase option.

Let’s look at some of the most common end of lease fees and how they can affect the attractiveness of a car lease buyout.

Want to purchase your leased car?

End-of-Lease Fees

Most likely you will have to pay at least one fee to your leasing company whether you choose to return your car or to buy it (check your lease agreement). The following is a list of possible end of auto lease fees you may come across. This list is not exhaustive.

Purchase Option Fee

If you choose to purchase your leased vehicle, your car leasing company will most likely require you to pay for the option of buying the car.

Remember that the market value of your car can be greater than your purchase price (i.e. the residual value). To protect itself from too much financial loss, your leasing company likely charges a purchase option fee to offset the risk of selling a car for less than it is worth.

Your purchase option fee is likely specified in your lease agreement. It can usually be rolled into your purchase financing so that you do not have to pay it up front.

Important Note

Many customers choose to purchase their leased vehicles through the dealership that originally secured the lease for them for an additional fee. While these additional fees can be reasonable, it is not uncommon for some dealerships to require unreasonably high, additional purchase option fees (up to thousands of dollars) over the purchase option fee specified in the lease agreement. In most cases, you have options to purchase your leased vehicle outside of a dealership and at a reasonable cost, such as through IFS or another financial institution.

Fees to Return a Leased Vehicle

Like with purchasing a leased vehicle, returning your leased car almost always comes with at least one fee. However, you may have to pay even more fees depending on the condition of your car.

Disposition Fee

If you return your car at the end of your lease, you most likely will have to pay a disposition fee. This fee is meant to cover all the costs that your leasing company will incur to sell the vehicle. Like the purchase option fee, the disposition fee is usually a few hundred dollars.

Excess Mileage Fee

For many lessees, the excess mileage fee is the most painful. When estimating your leased car’s depreciation and residual value, your leasing company has to assume that you will drive your car a certain number of miles per year, because mileage heavily influences a car’s value. If you drive your car more than the number of miles they assume you would drive (usually 12,000 or 15,000 miles per year), then your car will likely depreciate more than your leasing company expects. To cover any mileage related loss of value, and even to make more profit, your leasing company probably specified in your lease agreement that you will have to pay a fee for every mile you drive over your lease mileage limit, usually between $0.10 and $0.30 per mile.

So, if you drive thousands of miles over your maximum mileage limit, you will likely face a substantial fee if you choose to return your leased car at the end of your lease. The good news is that if you purchase your leased vehicle, you do not pay any mileage fees. For this reason alone, many lessees decide to purchase their leased cars.

As an example, suppose your leased car’s residual value (i.e. purchase option price) is $16,000, but it is worth only $14,000 on the open market. You probably do not want to buy your leased car for $2,000 more than it is worth. However, let’s suppose that your excess mileage fee is $4,000 (at IFS, we have seen mileage fees much higher than $4,000). Facing such a substantial fee, you would probably do well to purchase the car for $16,000 rather than to return the vehicle with a check for $4,000.

Wear and Tear Fee

If at the end of your lease, your car is in poor condition or is damaged, then your leasing company will probably charge you a wear and tear fee.

Like excess mileage fees, most leasing companies reserve the right to charge wear and tear fees to protect themselves from any damage that their vehicles face while on lease, because obviously a car’s condition greatly affects its market value.

Some lessees choose to buy their leased cars because they wish to avoid wear and tear fees. Obviously, if you buy your leased car for its residual value, your leasing company does not care about its condition.

Early Termination Fee

Most leasing companies want you to finish your lease. If you try to purchase your leased car early, then your leasing company will probably charge you an early termination fee.

Oftentimes, it is not easy to purchase your leased car until the last six months of your lease (but this rule is not set in stone). Different leasing companies have different rules about early termination of leases. Check your lease agreement or ask your leasing company to learn about its early termination requirements.

Your Knowledge of Your Leased Car

Buying a leased car is a tricky decision like any other car purchase. While the financial factors above are quantifiable – and thus in some ways make your decision to return or buy more straightforward – you should also consider other more qualitative factors when making your decision.

You may have many personal reasons why you want to return or buy your leased vehicle, but one thing to consider is that you have as much information as anyone about your leased car’s cleanliness and overall condition – because you have been driving it. For some people, if they cannot decide whether to return or buy based off of financial considerations alone, they simply make their decisions based off of whether or not they like their leased cars. For those who already like their leased cars, buying is especially attractive because it saves them the time, stress, and headaches of car shopping.

Financing Your Leased Car Purchase

Unless you have the cash to purchase your leased car on your own, you will need a lender that will pay off your leasing company and set you up with a car loan. Oftentimes, leasing companies will accept money from any reputable lender for the purchase of their leased vehicles.

However, just because your leasing company will accept almost any payoff does not mean that you should go with any car loan. If you have been leasing for a while, make sure you understand car loan interest and all the terms of any auto loan offer you get to ensure you are getting a fair deal.