Learn How Car Leasing Works And How It Differs From Buying A Car

Car leasing is not the same as car buying or renting a car. Whether you are about to lease a new car or deciding what to do at the end of your current lease, it is important that you understand the basics of car leasing.

What Is a Car Lease?

A car lease is an arrangement in which you pay your leasing company for the right to drive your leased car. Your monthly payments do not build equity (i.e. ownership) for you in the car. Rather, as you make your monthly payments you are simply upholding your side of the bargain that allows you to drive the car for a specified period of time, usually two or three years.

What Am I Paying for With My Monthly Lease Payments?

The two primary factors that determine how much you pay per month for your leased vehicle are its depreciation and your money factor.

Deprecation

Like all cars, as you drive your leased vehicle it depreciates in value, meaning the price it could sell for on the open market decreases. To account for this loss of value, your leasing company requires you to pay for the value it expects your leased car to lose as you drive it.

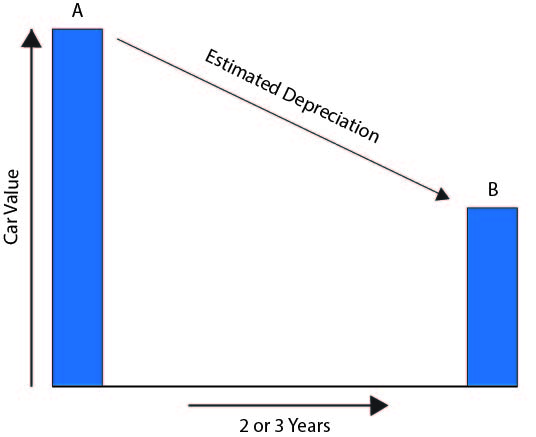

When you negotiate your lease, you and your car leasing company agree on how much the car is worth at the beginning of the lease and your leased company estimates how much it will be worth at the end of your lease. Ultimately, you have to pay for the difference between the car’s value at the beginning of the lease and what your leasing company expects it to be worth at the end of your lease. The graphic below illustrates the two values your leasing company uses to calculate the depreciation you pay for with your lease payments.

A: The capitalized cost of your leased vehicle (sometimes known as the Lease Price) is the value of the vehicle at the beginning of your lease plus any additional fees that your lease issuer adds onto it. The capitalized cost of your lease is negotiable before your lease, and, like the purchase price of a car, you want to get the capitalized cost as low as possible, because doing so will help lower your monthly payments.

B: The residual value of your leased vehicle is what your leasing company expects the car to be worth at the end of your lease. They calculate residual values based on historical data and on the number of miles they expect you to drive your vehicle, which is usually 12,000 to 15,000 miles per year. Note, if you choose to buy your leased vehicle at the end of your lease, you often have the right to buy it at the residual value no matter what the car is actually worth on the open market at that time.

The important point to take away from this graphic is that much of your monthly lease payments go towards paying for the depreciation on your leased car. Consequently, the higher your lease company sets your Residual Value (all other things equal), the lower your monthly payments will be. When the residual value is set high, how much you pay per month can be substantially less than you would pay if you had purchased the vehicle instead of leasing it. For this reason, people sometimes lean towards car leasing over car buying because leasing often allows a person to get a car for lower monthly payments than he or she could by purchasing it.

Sometimes, people like to think of leasing as buying part of a car. Only, the part of the car you are buying is the piece that the leasing company expects will depreciate away before the end of the lease.

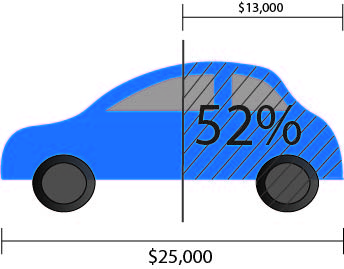

For example, let’s say you have a three year lease with a Capitalized Cost of $25,000 and a Residual Value of $12,000.

You would only pay for the $13,000 that depreciates away during the three years of your lease. You “buy” 52% of the car, because $13,000 is 52% of $25,000. However, you do not have any ownership of the car at the end of the lease because the portion of the car you pay for is gone. (Note, you do not actually buy part of your leased car with your lease payments. While some people like to think of leasing as buying part of a car, this way of thinking does not reflect the reality of leasing a car. With leasing, you pay to drive a car, not to purchase it.)

Money Factor

The other big piece that determines your monthly lease payments is your money factor, or lease factor. The money factor on a lease is like the interest you would pay if you took out a loan on a car. You pay money factor to compensate the leasing company for using its car and for the risk it takes by trusting that you will make all of your payments.

Money factors are not expressed in percentages the same way that interest rates are. Instead, they are written as long decimal numbers. To convert your money factor to an interest rate (APR) you will have to multiply it by 2,400.

Most lease agreements do not list what your money factor is. So, to learn what you lease factor is or will be, you will have to ask your leasing company.

What Additional Car Leasing Fees Do I Have to Pay?

Lessees are not always familiar with car lease terminology.

Your lease agreement likely lists many fees that you have to pay at the beginning and at the end of your lease.

At the beginning of your lease, you likely have to pay multiple lease inception fees such as title fees, acquisition fees, security deposits, and others.

At the end of your lease, you usually have to pay one fee no matter what you do. If you purchase the vehicle, you will have to pay a purchase option fee, and if you return the car to the leasing company, you will have to pay a disposition fee. Moreover, if you return the vehicle, you may have to pay a mileage fee if you exceeded your mileage limit or a wear and tear fee if your leased vehicle is in poor condition.