What Is An Auto Lease Capitalized Cost Reduction?

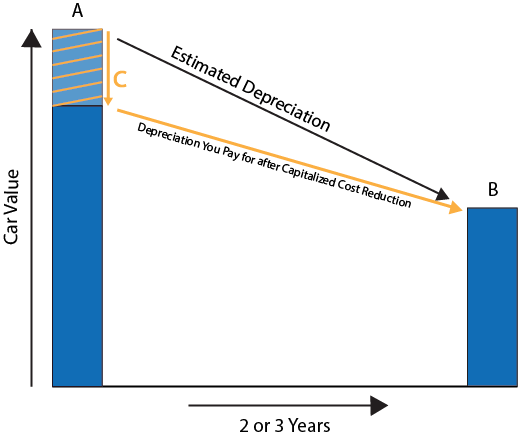

Under a car lease, you pay for the difference between the capitalized cost and the residual value of your leased vehicle. The capitalized cost represents the value of the car at the beginning of the lease plus any additional costs you roll into your lease. The residual value is the value your leasing company estimates your lease vehicle would fetch on the open market at the end of the lease.

At the beginning of a lease, you may have to pay a capitalized cost reduction. It is analogous to a down payment you might make when purchasing a car, except that a capitalized cost reduction payment does not help you build equity (i.e. ownership) in your car.

Still, a capitalized cost reduction benefits you in that it can reduce your monthly lease payments. Depreciation is one of the two big things you pay for with your lease payments (your money factor, which is like interest, is the other). When you make a capitalized cost reduction payment, you bring down the difference between your leased vehicle’s capitalized cost and its residual value, meaning you pay for less of this difference during the course of your lease with your lease payments.

A: Capitalized Cost

B: Residual Value

C: Capitalized Cost Reduction