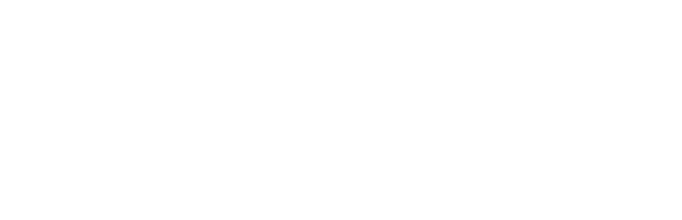

Pre-Qualification: The Roadmap to Your Car Goals

Every well-rounded person gets hit with a moment of humility now and then. It acts as a little reminder that, whoops, you may not know as much as you think you do.

Those inevitable slip-ups might be great for character development, but they’re a lot less fun when you’re doing something important — like trying to ace a job interview or score a good auto loan.

If you’ve ever researched loans and gotten overwhelmed with terms like car loan pre-qualification, pre-approval, and approvals, then you’re not alone.

That’s why we’ve developed this handy-dandy guide. By taking a few minutes to learn about the car loan pre-qualification process, you’ll be better prepared to compare auto loans and avoid slip-ups in the future.

What Does Car Loan Pre-Qualification Mean?

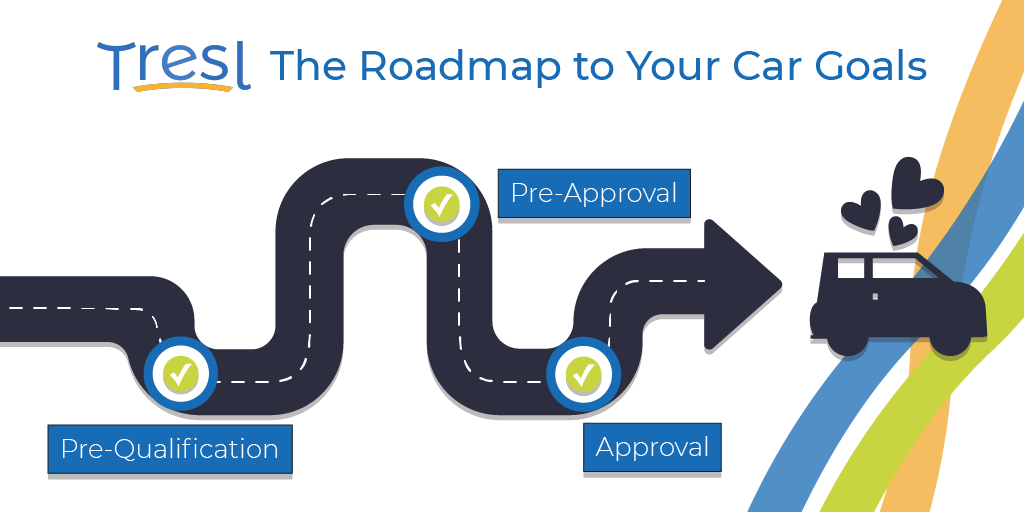

A car loan pre-qualification is an initial, conditional offer based on preliminary information. When you pre-qualify, you’re not required to apply for the loan — you’re simply testing the waters to see what rates may be available to you.

But be warned: not all pre-qualification processes are made of the same caliber. Some will only give you a yes-or-no answer while stronger companies will let you review a variety of interest rates and term lengths.

Most pre-qualification systems run a soft credit inquiry to analyze general factors in your credit report. Still, companies who are worth their salt will also analyze vehicle valuation data to maximize the accuracy of their offer. Tresl uses both.

That’s great news! It means you’re one step closer to understanding what kind of monthly payments and interest rates you may get.

But you’re not in the clear yet.

A lender can’t approve you for a loan before you apply for one, so even if you are pre-qualified, you still need to apply before locking in those rates. Even then, your pre-qualified offer can’t guarantee that you’ll get approved.

So What’s the Point in Getting Pre-Qualified Car Rates?

Think of pre-qualification as the first step toward getting a competitive car loan.

It’s like watching a series of trailers before going to the movie theaters. While the trailers may not guarantee that you’ll end up liking the movie you choose, they’ll give you a sneak peek so you can make an informed decision.

What Does Car Loan Pre-Approval Mean?

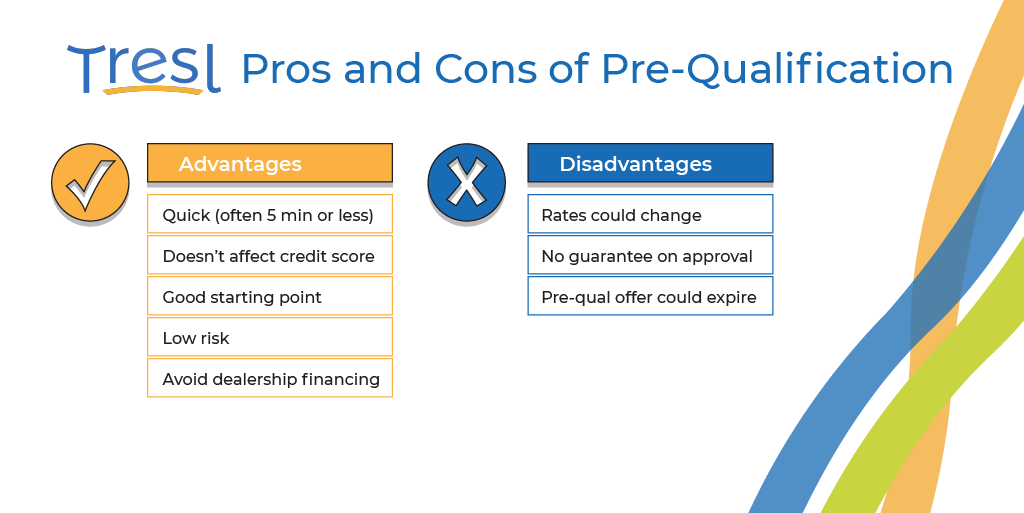

Pre-qualification, pre-approval . . . tomato, tomahto, right? Not exactly.

While the two terms share a lot of similarities, there’s actually one key difference: Pre-approval requires verified personal information like your income.

Unlike with car loan pre-qualification, you’ll have to spend a little time gathering accurate, verifiable information like the following:

- Income

- Proof of insurance

- Photo ID

- Residency information

(They’ll also make a hard credit inquiry, which may temporarily hurt your credit.)

Though your pre-approved offer might change when it comes time for final approval (especially if your financial situation changes), it comes with some serious bargaining power.

Say, for instance, that you’re planning on buying a car from a dealership. If you get pre-approved before speaking with a salesman, you can skip right past their financing games because you already know the type of auto loans you qualify for.

When to Get Pre-Qualified and When to Get Pre-Approved

Your car loan strategy is your own and the timing is ultimately up to you. But if you were to ask our advice, this is what we would suggest:

Get pre-qualified when you’re toying with the idea of getting (or refinancing) an auto loan. You’ll get a big-picture view without investing too much time.

Get pre-approved right before you buy, lease, or refinance a car. Remember, most hard credit inquiries in a 14-day period are grouped into one, so it’s better to go on a rate-shopping spree than get pre-approved once every few weeks.

Remember, car loan pre-qualifications and pre-approvals aren’t required auto financing steps. Both have distinct advantages and disadvantages, so you should choose the one(s) that fits your situation.

At Tresl, for example, we focus on pre-qualification and applications because we manage the entire process for you — all the way to titling and registration. If you decide you like your pre-qualified offer, we can take you straight to the approval review step.

How to Get Pre-Qualified in 5 Minutes or Less

Ready to take the first step toward your car goals? Here’s how:

- Pre-qualify with Tresl in 5 minutes or less. We’ll ask you to provide basic contact and vehicle information to match you with your pre-qualified offers.

- Review your pre-qualified offers. You can customize each offer before choosing one.

- Submit your pre-qualified application. A dedicated Tresl Finance Advisor will walk you through the full loan application process. We’ll even take care of your titling and registration!

Want to learn more before jumping in? Contact us to speak with a Finance Advisor or visit our Facebook page to see what we’ve been up to!